Table of Content

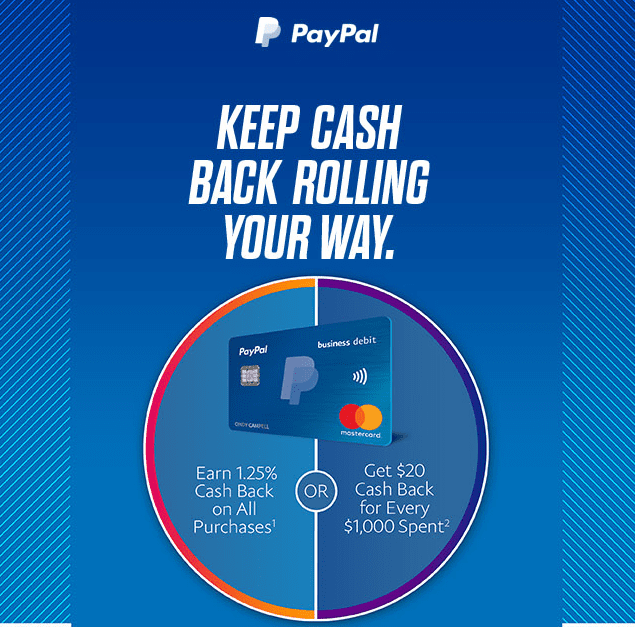

This unlocks priceless switch partners likeUnitedandHyatt— and whenever you add in the truth that the cardboard carries no annual charge, it’s a strong worth proposition all around. 2% cash back on the first $50,000 eligible purchases every calendar year, then 1% money again. You can add cardholders to your account and earn cash again based on their purchases. There’s no annual cap on rewards redemption and as lengthy as your account remains in good standing, your money rewards don’t expire. The larger cashback charges can only be earned on the primary $50,000 in mixed alternative and restaurant purchases each calendar year. After that, the rate drops to 1% money again on those purchases.

Moreover, should you pay off your balances in full every month, the cash again incentives equate to free money. All told, there are numerous completely different options obtainable to help your business maximize rewards. If you should make huge business purchases you gained't have the power to pay back immediately, a 0% intro APR on purchases is the best choice.

Which Bank Card Provides The Best Credit Score Limit?

For occasion, you'll be able to think about utilizing your cash-back as a press release credit score when you won’t have the funds for to pay your next bank card fee. Usually, you might additionally switch your a reimbursement into a bank account. On the opposite hand, you possibly can resolve to contribute your money back to a charitable organization when you intend to do your half to further a certain trigger.

Depending on the cardboard you get, you may earn a flat money back fee across all purchases or the next rate based mostly on specific categories. For instance, the Ink Business Unlimited® Credit Card presents flat 1.5% money again on all purchases. If you’re looking for a shopper cash again bank card that you may use for business-related spending, think about checking our selection of prime money back playing cards for people. We just like the no-annual-fee American Express Blue Business Cash Card because it enables you to earn 2% cash back on all eligible purchases as a lot as $50,000 per 12 months and 1% money again thereafter. Its 0% APR provide on purchases stays in place for the first 12 months.

Take Pleasure In Limitless Free 1% Cashback

We endeavour to make certain that the data on this website is current and correct but you should confirm any information with the services or products supplier and read the data they can present. If you're unsure you should get independent recommendation earlier than you apply for any product or decide to any plan. Find out how the Payhawk Corporate Visa card works to see if it’s right for you and your business.

It’s also a lot less complicated and doesn’t require a time investment so as to redeem rewards. Travel rewards, similar to airline miles or hotel points, can be strategically redeemed to get outsized value. Every journey program has sweet spots the place a single point or mile might be worth 5 or ten cents every when redeemed strategically. However, this assumes you’re well-versed on the program’s strengths—and have the flexibleness to benefit from them. Depending on your preferred redemptions, different forms of bank card rewards may be more valuable to you.

High Presents From Our Companions

Business bank cards providing a reward on purchases can probably put important dollars into your small business account. However, when reviewing and evaluating reward programs for a business credit card, you have to contemplate whether or not the card earns factors or money again. Having a cash-back credit card for your small business can be a nice way to earn in your everyday purchases and get some money back to use elsewhere. Even should you pay an annual fee, redeem rewards in order to benefit from the spending you do and all of the perks that are included with the card. This is a great cash-back bank card for businesses who need to construct on their banking relationship with Bank of America, like if you already have a enterprise checking account with them.

You can usually redeem your rewards as a press release credit score, a deposit into a linked business checking account or a bodily examine, depending on the cardboard. The benefits are fairly limited, but the card has no annual charge, and once you construct your corporation credit, you can apply for extra valuable playing cards in the future. When you're permitted for the cardboard, you can earn a $300 assertion credit after you make at least $3,000 in purchases within the first ninety days of your account opening.

Finest Capital One Card With Unlimited Flat-rate Cash Again: Capital One Spark Money Choose For Excellent Credit

And in case your primary concern is building credit score or paying down debt, there are alternatives for you too, among secured and balance-transfer playing cards. Many card issuers offer proprietary points instead of conventional money again. These packages, like Chase Ultimate Rewards or Citi ThankYou points, construct in flexibility.

Keeping business and personal expenses separate makes issues simpler at tax time, for starters, so making private purchases on your small business credit card could make things tougher to trace. Some credit card issuers additionally take a dim view of making private purchases on a enterprise bank card, so it's best to keep away from the apply. You'll earn 1.5% limitless cash-back rewards on all purchases with the Spark 1.5% Cash Select for Excellent Credit.

Why Get A Business Cash Again Card?

Bank Business Leverage Visa Signature provides you a longer time interval to earn that bonus cash back , that means you’re more prone to really get it. Like some other playing cards on this record, Spark 2% Cash Plus from Capital One earns a flat rewards rate―but it earns the next rate than those other cards do. That method, you may get a card that earns plenty of cash rewards―and that matches your business’s needs too. The scoring formula takes under consideration the kind of card being reviewed and the card's rates, fees, rewards and other options. Earn a $500 bonus when you spend $4,500 within the first 3 months of account opening. Earn up to a $1,000 money bonus; $500 when you spend $5,000 within the first 3 months, and $500 once you spend $50,000 within the first 6 months of account opening.

You’ll find offerings from on-line banks and a few national banks, including Bank of America. Opinions, reviews, analyses and proposals are the author’s alone and have not been reviewed, endorsed or permitted by any bank, credit card issuer, lodge, airline, or other entity. Using this card when traveling outdoors of the us makes sense because it doesn't cost any worldwide transaction charges. Integrating your Ink credit card with bookkeeping software program is easy and simplifies accounting. One of the simplest ways they do that is by offering cashback playing cards. For these months when the enterprise wants slightly extra wiggle room, The Plum Card has your back with up to 60 days to pay with out curiosity.

Depending on your spending, this match can easily exceed the bonuses you'll find a way to earn from other cards. Even after the primary year, the Discover it® Cash Back, with its rotating bonus classes, presents solid rewards. The Wells Fargo Active Cash® Card is a Forbes Advisor top pick for a flat-rate cash-back card, incomes 2% money rewards on purchases. The Capital One Spark Cash Plus is a business cash-back card that offers 2% on all purchases. If your small business spends more than $7,500 annually and doesn’t wish to sustain with multiple bonus categories, this is the right card for you. American Express helps enterprise homeowners pursue progress alternatives, cope with sudden prices and pay for larger purchases with Expanded Buying Power.